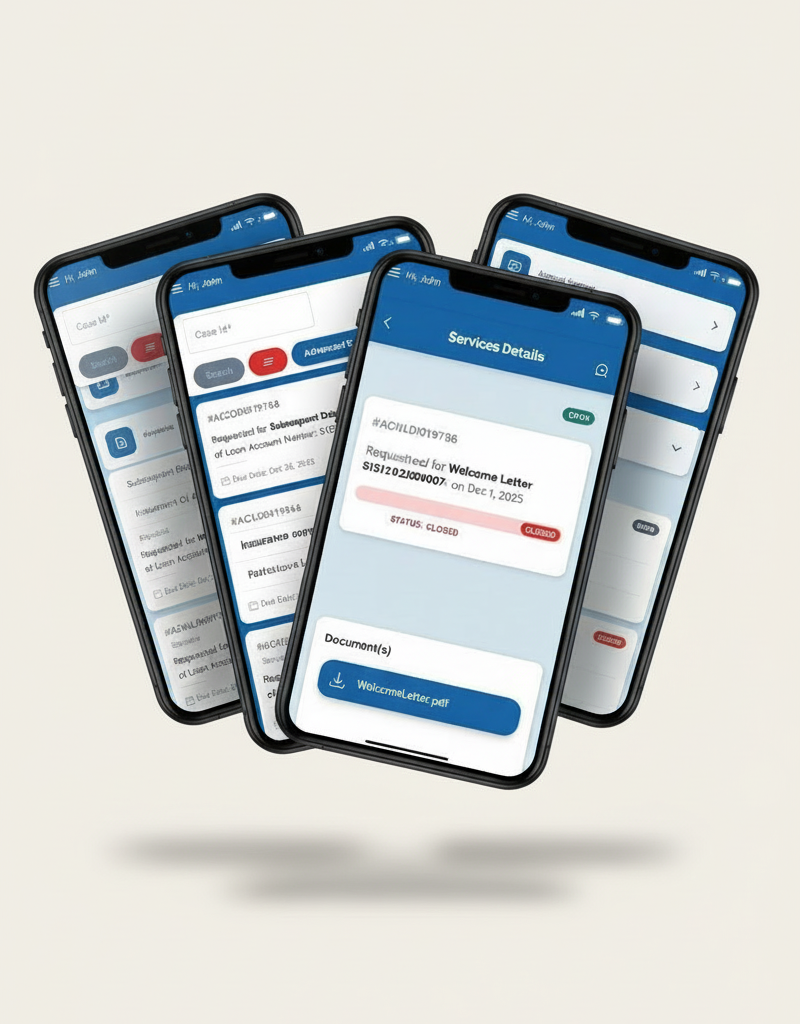

Complete Loan Visibility

Empower your borrowers with real-time access to their loan data. No more calling support centers to ask "How much do I owe?" or "When is my next EMI?".

-

Real-time Loan View

Live view of principal, interest, overdue charges, and total outstanding.

-

Repayment Schedule

Clear visualization of past payments and upcoming EMI dates.