Streamline Your Treasury

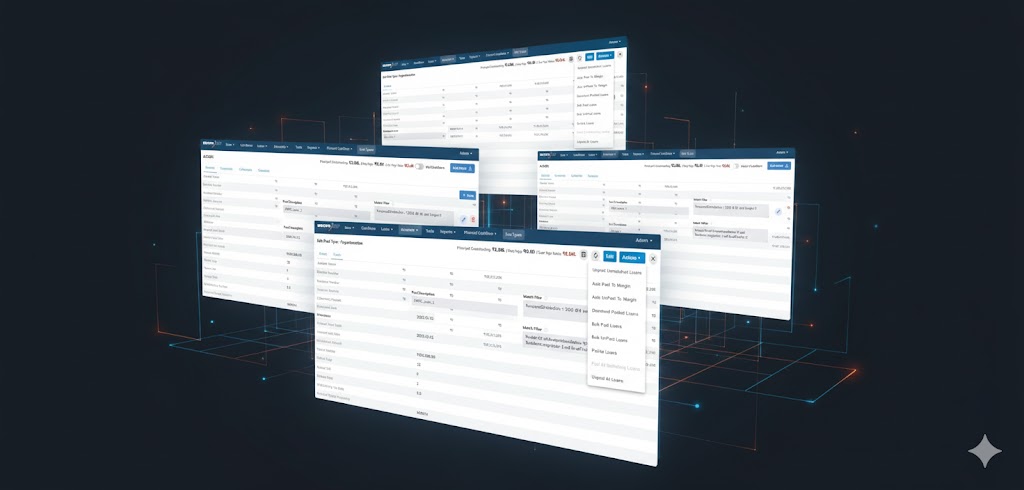

Encore Treasury Management System is a specialized solution designed to help Indian NBFCs manage their investments, liabilities, and lender relationships with confidence and clarity.

Traditionally, NBFCs rely on manual Excel workbooks—an approach that is prone to errors and discouraged by regulators due to data manipulation risks. Encore automates these workflows, bringing everything into a secure, single platform tailored to Indian regulatory realities. Whether tracking hypothecation or monitoring covenants, Encore ensures you are compliant and efficient.