Trusted by 60+ Financial Institutions

Powering the leaders in lending.

From agile fintech startups to established NBFCs, the industry's most innovative players rely on Encore360 to scale operations, ensure compliance, and drive growth.

Encore360 delivers Speed, Scale and Governance. It empowers your business to accelerate new lending products launch, operate at enterprise scale and maintain integrated regulatory compliance.

Your signature sourcing journeys composed with diverse digital acquisition, qualifying business rules, flexible credit approval flows, towards high quality loan applications.

Automate your Hypothecation with multiple lenders, keep a continuous watch on your Covenants and Asset Liability Mismatch

Collect and reconcile repayments instantly across channels – NACH mandates, BBPS/UPI, digital payment links by telecaller, and secure field collections with QR/cash/cheque.

Simple, secure self-service capabilities, providing borrowers instant access to loan status, payment schedules, statement of accounts, and integrated help desk assistance.

Trusted by 60+ Financial Institutions

From agile fintech startups to established NBFCs, the industry's most innovative players rely on Encore360 to scale operations, ensure compliance, and drive growth.

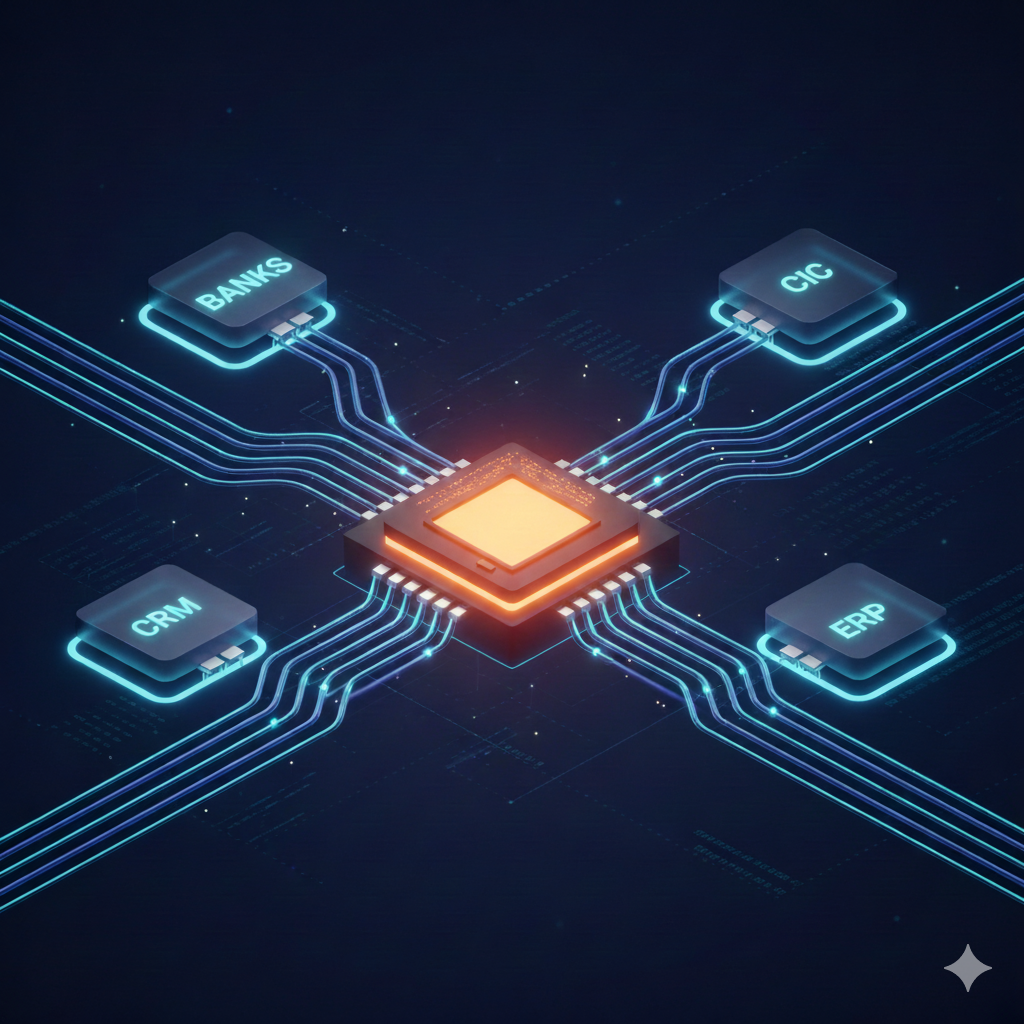

Encore360 comes ready-to-use with essential integrations, eliminating months of API development and reducing time-to-market.

Integrations for e-KYC, e-Sign, and Video KYC for seamless customer acquisition.

Automated credit checks and risk scoring to streamline decision-making.

Direct, secure connections for fund disbursement and reconciliation.

Native integrations with banks and gateways for BBPS, NACH, UPI, and Virtual Accounts.

Don't wait for batch jobs. Encore pushes instant events to your CRM and ERP. Whether it is triggering a welcome email via Salesforce upon disbursement or updating the General Ledger in SAP, Encore ensures your data is always synchronized.

We go beyond standard SLAs. Our dedicated team of domain experts works alongside you to ensure your operations run smoothly, adapting quickly to your evolving business needs.

Schedule a personalized demo to see how Encore360 can transform your loan portfolio management, automate compliance, and scale your growth.

Complimentary consultation with our lending technology experts.